Clark Wealth Partners - Questions

Table of ContentsGetting The Clark Wealth Partners To WorkOur Clark Wealth Partners StatementsThe Definitive Guide for Clark Wealth Partners3 Simple Techniques For Clark Wealth PartnersThe Ultimate Guide To Clark Wealth PartnersAll about Clark Wealth PartnersClark Wealth Partners Can Be Fun For AnyoneGetting The Clark Wealth Partners To Work

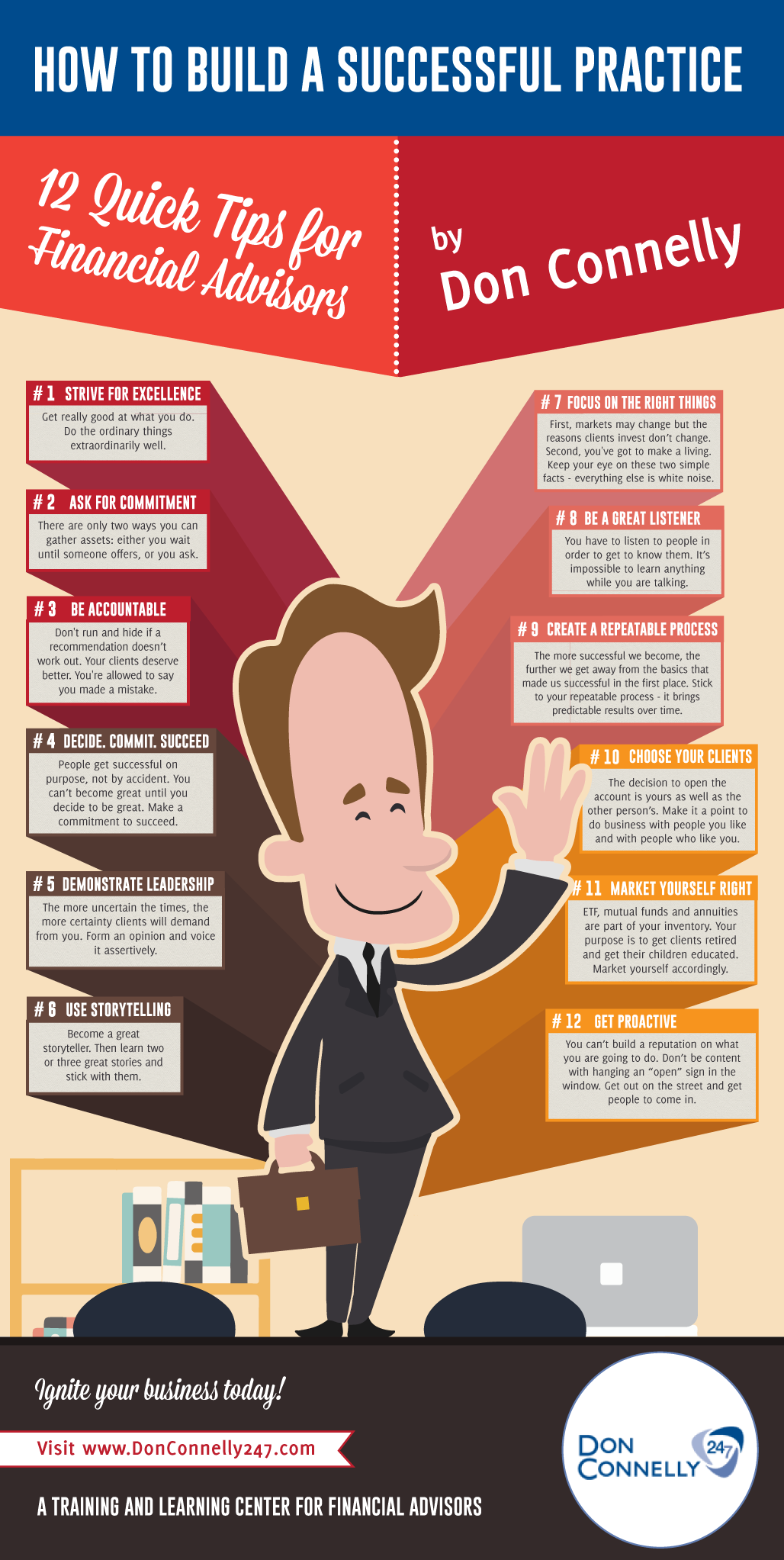

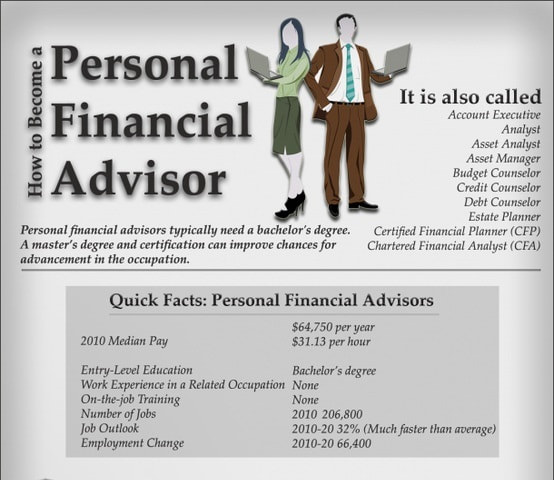

Whether your objective is to make best use of lifetime giving, ensure the care of a reliant, or assistance philanthropic reasons, strategic tax and estate preparation aids shield your legacy. Investing without a strategy is just one of one of the most usual pitfalls when constructing wide range. Without a clear strategy, you may yield to panic offering, constant trading, or portfolio imbalance.I've attempted to state some that mean something You really want a generalist (CFP) who may have an extra credential. The idea is to holistically consider what you're attempting to complete and all finance-related areas. Especially because there might be tradeoffs. The CFP would certainly then refer you to or work with attorneys, accountants, etc.

Fascination About Clark Wealth Partners

Likewise this is possibly on the phone, not personally, if that matters to you. commissions. (or a mix, "fee-based"). These organizers are in component salesmen, for either investments or insurance policy or both. I would certainly stay away however some individuals fit with it - https://anotepad.com/notes/4mg4qd77. percentage-of-assets fee-only. These planners obtain a charge from you, yet as a percent of financial investment properties took care of.

There's a franchise Garrett Preparation Network that has this kind of organizer. There's a company called NAPFA () for fiduciary non-commission-based planners.

The 45-Second Trick For Clark Wealth Partners

There have to do with 6 textbooks to dig via. You will not be a skilled professional at the end, but you'll know a great deal. To obtain a real CFP cert, you require 3 years experience in addition to the training courses and the test - I have not done that, simply guide understanding.

bonds. Those are one of the most essential investment choices.

What Does Clark Wealth Partners Do?

No two people will certainly have quite the same collection of investment techniques or services. Depending upon your objectives along with your resistance for risk and the time you have to pursue those goals, your expert can assist you determine a mix of investments that are ideal for you and developed to assist you reach them.

Ally Financial institution, the firm's direct financial subsidiary, offers a selection of down payment items and services. Credit history products are subject to approval and extra terms and problems apply.

Ally Maintenance LLC, NMLS ID 212403, is a subsidiary of Ally Financial Inc. The information included in this post is offered general educational purposes and should not be interpreted as financial investment suggestions, tax obligation suggestions, a solicitation or offer, or a recommendation to get or sell any kind of security. Ally Invest does not supply tax obligation advice and does not represent in any type of manner that the outcomes explained here will certainly cause any kind of certain tax repercussion.

Little Known Questions About Clark Wealth Partners.

Securities products are andOptions involve risk and are not appropriate for all investors. Choices financiers might shed the whole amount of their financial investment or more in a reasonably short period of time.

The Facts About Clark Wealth Partners Uncovered

App Store is a solution mark of Apple Inc. Google Play is a trademark of Google Inc. Zelle and the Zelle related marks are wholly possessed by Early Warning Providers, LLC and are utilized herein under license. Ally and Do It Right are licensed solution marks of Ally Financial Inc.

Handling your financial future can really feel overwhelming. With a lot of moving partsinvestments, retired life, tax obligation strategies, threat management, and estate planningit's easy to really feel shed. That's where monetary consultants and monetary planners come inguiding you with every decision. They can read here function together to help you plan and remain on track to reach your goals, however their roles stand out.

Some Ideas on Clark Wealth Partners You Should Know

Market fluctuations can cause panic, and tension can cloud huge choices. A monetary advisor helps maintain you based in the day-to-day, while a financial coordinator guarantees your choices are based upon long-term objectives. With each other, they are objective and aid you browse unstable times with confidence rather of reactive feelings. Financial advisors and monetary organizers each bring different capability to the table.

Do you prepare to retire eventually? Perhaps obtain wed or go to university? Exactly how around paying for some financial obligation? These are all reasonable and achievable monetary goals. For a lot of us, nevertheless, it's not always clear just how to make these dreams come to life. Which's why it might be a great concept to get some professional help.

A Biased View of Clark Wealth Partners

While some consultants provide a broad array of solutions, several specialize only in making and taking care of investments. A good expert needs to have the ability to use assistance on every element of your financial circumstance, though they may concentrate on a specific location, like retirement planning or wide range management. Make sure it's clear from the get-go what the expense includes and whether they'll invest even more time focusing on any kind of area.